The IB/IGB companies

The consulting team assessed 300+ companies suggested through literature and online information, recommendations from various stakeholders, and a public call. OF the 300 companies the team shortlisted about 50, did further analysis on those, and then further interviewed, assessed and then rated 28 firms. Of these 15 companies were found eligible to qualify as either IB or IGB. Some more interviews are lined up. These 15 companies are recommended to the accreditation committee for official accreditation and endorsing for IB/IGB award under the AGI business award on 9 November 2024.

The company selection and accreditation will continue in 2025 and thereafter. It is assumed that every year about 20 companies will then be accredited. Seven of the 15 companies have small IB/IGB business lines (by revenue), 4 medium and 3 large. 12 firms are real IB and 3 potential IB. 10 of the 15 bring IB solutions to the income and 3 to the living standard problems of the BoP and 2 address problems in the environment. 9 firms engage the BoP as suppliers, 1 as worker, 7 as consumer and 1 as a shareholder (cooperative model); multiple categories were for 3 companies. Only 3 companies had also some relevant women empowerment features (beyond women engagement), 5 had deliberately designed environment impact features and 4 climate change related features.

By sector, 6 of the 15 firms are in agribusiness (Antika, Benso Oil, Esoko, Kuapa Kokoo, Rock Farm, Third Well), 1 in textile (Maa Grace), 1 in logistics (Yom Yom), 2 in finance (Sinapi Aba, Vision Fund), 2 in health (mPharma, New Crystal hospital), 1 in plastic recycling Trashy Bags), 1 in sanitation (WashKing) and 1 in organic waste to energy (Zuriel). The 15 companies had in 2023 a consolidated revenue of GhC 988 million (ca USD 66 million at as current exchange rate of 1:15), growing to projected 1.9 billion by 2030 (nearly double in 7 years).

More impressive is the social reach of those 15 firms. In 2023 they reached 2.7 million people of which 1.9 million (77%) came from poor and low-income households (the BoP). By 2030 social reach will go up to 2.9 million BoP people (53% increase) and 4.5 million people in total. Imagine, if 15 IB/IGB companies are so successful in revenue and reach, how much more can be achieved when the IB/IGB initiative is scaled up.

The public call to find new IB/IGB

One of the sources to find IB/IGB companies is organizing a public call, other sources are information from the internet and literature, and personal recommendations. In December 2023, GIZ and CDC Consult did the first public call on IB/IGB of which 118 companies responded, of which 71 were micro-enterprises, 23 small firms, and 5 medium sized firm. Of these 28 companies were closer looked at and 6 companies prioritized for interviewing. Of which at the end 3 made it as IB/IGB.

It was found that a public call is an important instrument to find IB/IGB companies, but other mechanisms like

- background reading in the press, internet and literature, and

- particularly direct recommendations need to be added.

The next public call will be in the first quarter of 2025, so that companies can be interviewed between April and September and the next (2nd) accreditation round be scheduled for the third quarter of 2025.

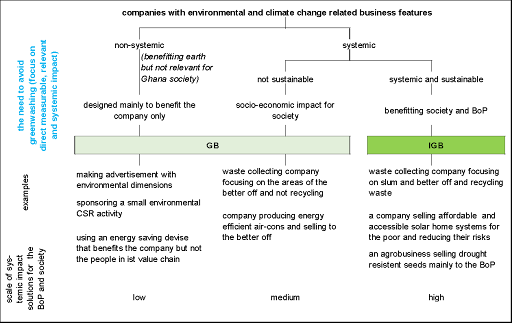

Transforming Green Businesses (GB) into Inclusive Green Businesses (IGB)

In the public discussion – and following a global trend – here is a strong emphasis on Green Business (GB) in Ghana both among government agencies and development partners but also among companies themselves. However, there is – apart from sector taxonomies, no coherent system to identify such companies through detailed criteria and a transparent identification process. To date, mostly self-claiming is used. The IB/IGB initiative adds to this by offering a transparent company identification tool for Inclusive Green Business.

Green Business differ from Inclusive Green Businesses (IGB) in three major areas:

- IGB avoid self-claiming and trickle down assumptions; rather they use identified relevant outcomes to determine their actual results to contribute to a better environment or more climate friendly production.

- The environmental benefits of IGB are assessed not only it their value for the company (e.g. solar panels to reduce the company’s electricity bill), but also in its relevance for the society and economy. And

- IGB need to have direct benefits for the poor and low-income people (BoP) in the environments of the poor.

The IB/IGB discussion has introduced 6 clear criteria to identify Inclusive Green Business. As in the case of IB, the company’s performance is rated against those criteria in low-medium-high results, qualifies through numbers between 0 and 6 (high). The 6 criteria blocks are given below and each block has additional sub-criteria.

- contribution to reduce pollution in the economy

- value addition to manage natural resources

- involvement in reducing the climate footprint (not only of the company, but also more systemically also for the country)

- the quality of its environmental sustainability meaning how comprehensive and deep it addresses environmental and climate challenges in the sector

- how the environmental feature make business sense, and

- how the environmental feature directly benefits the BoP

The scoring of these criteria rating is multiplied with the 6 relevant environmental and 3 relevant climate dimensions an IGB company in the respective sector should address. For the environmental sustainability these are related to challenges and opportunities regarding

- Soil and land preservation,

- Water management,

- Air pollution,

- Biodiversity improvements,

- Waste management, and

- Input reduction and reuse of material (circular economy).

The climate change related dimensions are

- Greenhouse gases mitigation,

- Climate adaptation, and

- Climate resilience practices.

The result is a final scoring for measuring the environmental and climate change impact of an IGB. The maximum impact scoring for IGB (45%) has the same weight than the maximum impact scoring for an IB. Also, to make both company types comparable in their rating, commercial viability (41%), innovation (14%) and strategic intent (100%) weights are the same between IB and IGB.

Transforming Mainstream Businesses into Inclusive Businesses

Inclusive Businesses are deliberately designed to achieve positive systemic solutions for the relevant income or living standards problems of the poor and low-income people (the BoP) . They create triple wins for the poor, for the businesses bottom lines and for society/the economy.

Both IB and IGB strive to be commercially viable and profitable. However, mainstream business do not have the a deliberate result focus on solutions for the BoP. Their main focus is on business return. While they may have products and services that also benefit the BoP they are not designed to maximize those benefits for this income group.

Sometimes, mainstream businesses (MB) and also IB) finance corporate social responsibility (CSR) activities benefitting the BoP or the environment. Such CSR is typically small, financially not sustainable, not part of the core business line, and – while benefitting some few people – often not systemic to address poverty or environmental issues relevant for society.

The objectives of the IB/IGB initiative is to help transforming MB into business more purposeful for the BoP and the environment. IB/IGB are therefore the private sector’s contribution to achieve poverty reduction and transformative economic growth in Ghana.

The important role of business associations

Business associations play a crucial role in promoting the IB/IGB agenda. They can

- Do advocacy among their members to transform the businesses into IB/IGB;

- Promote impact drives return type of business coaching and mentoring (IDR-BCM) under their own private sector support programs;

- Support policy work around the IB/IGB agenda, especially in their exchange with government, and argue for specific investment incentives (link to page 4.6) in support of such companies; and

- Play a leading role in the. IB/IGB institutions ., such as the secretariat, the accreditation committee, and the Board.

The social enterprises agenda

Social enterprise is a rather diffuse terminology. The literature names companies that address societal problems, create a social rate of return, and see profit maximization not as the sole goal of entrepreneurship as social enterprises or social business Some definitions also require the use of profit to be reinvested in the social purpose of the business, while others go even a step further and require no profit to be made at all. Others see any start up business with new ideas already as a social enterprise, no matter whether the benefit would be for poor or for better off people.

Social enterprises (SE) is based on self claiming: Despite the wide use of the terminology, there is – also in Ghana – no agreed system with accepted criteria that prove what the social enterprises are actually doing and how their assumptions and claims actually benefit people and planet. Many mainstream businesses also create a social or environmental rate of return and claiming claim to contribute to poverty reduction, environmental and climate sustainability, and innovative technology development is not the same than proving that societal changes really happen..

There are two types of social enterprises:

- NGO-driven social enterprises which may be profitable (or not) and derive most of their revenues from grant contributions. These type of SEs are the large majority of SEs in Ghana.

- For profit social enterprises earning the majority of their funding through market principles (or being on the way to do so) and scaling their impact to be more relevant for society. Although often small in scale of impact and revenue, this second category of SE is part of the IB/IGB agenda and included as IB/IGB initiative.

Large numbers: Studies commissioned by SEGh suggest that there are about 130,000 social enterprises comprising 6% of all SMEs. However this number does not seem to be consistent as 6% of the total 640,000 companies counted in the latest (2016) company census is 38,400 firms. So these large numbers seem to be heavily overstated given that the studies use a very broad definition, and include all cooperatives, many NGOs and CSR activities, and nearly all start-up mainstream business.

Real impact rather questionable: The same studies claim that these enterprises (a) had in 2022 a consolidated revenue of GHC 23 billion revenue (4% of GDP), averaging to GHC 0.2 million revenue per company., (b) employ 808,000 people (3% of employment, 7 persons on average), and (c) create 80,000 new jobs per year (however the additional jobs are not netted because many firms disappear in short time). Again this is probably overstated and requires a more scientific data update

Social Enterprises Ghana (SEGh) : a registered network of SEs (and support institutions) in Ghana has 1,100 registered members, of which much less (perhaps 25%) are really active.

The SE bill: Since 2017 the social enterprise movement in Ghana aims for a law on social enterprises with a separate business registration system, an institutionalized support organization and a fund to (mostly grant-) finance such firms. However this proposed social enterprise law is not moving. SEGh Ghana therefore favors including the SE agenda under the IB/IGB agenda as this may bring more tangible benefits to at least some SEs.

Bringing the SE and the IB/IGB agenda closer: Since 2024, the leadership promoting the SE agenda in Ghana is an active promoter of the B/IGB movement. For profit social enterprises are increasingly interested to transition into IB/IGB initiatives. Also the IB/IGB program activbely promotes the incousionm of the SE agenda by

- including Social Enterprise Ghana (SEGh) as business association representative in the IB/IGB accreditation board;

- doing advocacy work with SEGh and its members to transition into IB/IGB,;

- providing impact drives return business coaching and mentoring (IDR-BCM) (link to page 4.5) to some SEs; and

- offering the same incentives to commercially viable SE transforming into IB/IGB than to IB/IGB.

Transforming CSR into IB activities

Corporate Social Responsibility (CSR) are activities of the private sector, which is not part of the core business of a company, but financed from the business profit, to address social and environmental concerns. Most CSR is very small, and comprises some funding for scholarship, hospital support, tree plantation and environmental cleaning, and family support. The funding is very small (typically less than 3% of the net profit of a firm, in Ghana between GhC 20,000 and GhC 1 million), and not sustainable in its financial contribution is heavily fluctuating.

Furthermore, the quality of CSR to actually make a change in society (even at small scale) is often questionable. Many times CSR – while helping a few poor families – is not addressing the root causes of poverty or environmental problems and thus persists poverty Therefore more systemic approaches in the use of CSR are discussed internationally, e.g. the establishment of foundatio9ns with clear objectives, professional implementation, and sustainable financing (such as Gates Foundation).

Transforming CSR into IB/IGB activity: In the IB/IGB discussion, general CSR work is not seen as IB/IGB eligible. However, CSR work that is transformed to pilot test a new core business line would qualify as IB/IGB activity.

Ghana has an active corporate social responsibility scene. CSR is typically done by mainstream business. Many IB/IGB firms do not have CSR activities, rationalizing this with the fact that their total business is deliberately designed to achieve large scale social or environmental impact. Many social enterprises also do not have CSR because of their very small revenue and profit availability. Unlike in other countries (e.g. India) doing CSR is in Ghana not mandated by the law for medium and large size industries. While some companies have sustainability reports, research on CSR in Ghana is a bit dated, more theoretical, and less quantitative.

CSR awards: Since 2013 the Centre for Corporate Social Responsibility & Sustainability (CSR) West Africa, a leading CSR and Sustainability advocacy organization in the West African subregion is organizing the Ghana CSR Excellence Awards in collaboration with the Association of Ghana Industries (AGI) and other partners.

AGI has an established an Environment, Social and Good Governance (ESG) award as part of its Ghana Industry Quality award. (link to the ESG page under AGI: ,the next being given on 16 November 2024in the World Trade Center in Accra.

IB/IGB and the impact investing agenda

Investments in IB/IGB are mostly done by impact investors and some selected banks or financial institutions. Impact investors are firms with a double bottom line of generating financial returns and social or environmental impact. Sometimes also banks, grant institutions, and development partners are investing in IB/IGB. The IB/IGB discussion subsumes the sum of all such investments under impact investing. However, while impact investors invest in impact and subsume any investment in planet, people or technology and innovation under impact investing, only a few such investments globally have a deliberate and of these again a small share are actually for IB/IGB purposes.

Impact investing should not be confused with the delivery of grants. In fact, while being part of the portfolio of impact investors, the availability of grants are rather small. Most impact investors place equity, some loans, and other an innovative mixture of loans, equity and grants. Impact investors do not necessarily maximize their financial return. Sometimes they compromise on interest rates when they see a clear social or environmental return. Most impact investors however invest through equity with targeted 5 years exit strategies. The funds are typically provided against clearly described deliberate impact objectives against benchmarks combining commercial with social ort environmental targets. Impact investing is typically in the range of USD 0.1-3 million (sometimes more), while the fewer grant providers have ticket sizes between $5.000 and $100,000.

The 15 minutes pitching trials many social enterprises do is typically only for much smaller ticket and often grant based sizes;. Compared to the many applications, the success rate of such pitching is rather low (1:10 in the shortlisting and 1:100 in the longlisting exercises). For larger ticket sizes applications, and for outlining the financial return detailed transformation business plans are required. These need to show in dynamic projections how the company will transform to achieve higher or more impact

The 2022 impact investing landscape report done by Impact Investing Ghana (IIGh) and the Ghana Venture Capital Association (GVCA) suggests a major growth in venture capital and private equity in the last decade, reaching in 2023 nearly USD 7 billion investments accumulated. The report mentions 38 venture capital and private equity funds, 12 development financing institutions, 27 corporate pension trustees, 7 grant institutions, 7 crowdfunding platforms, 5 guarantee funds, 23 commercial banks, 145 rural banks, and 180 microfinance institutions active in Ghana. However only a small part of this is relevant for IB/IGB investing, such as perhaps

- the 5 impact funds active in Ghana (examples are: Brighter Investment, CiGaba Fund, Deal Source (a platform), Injaroo Invest, Lend-a-hand (crowd funding platform) New Venture Fund, Mirepa Capital, Oasis Capital, Palladium Capital, RISA Fund, Wangara Capital, Wangara Green Venture,. Yaro Capital Zebu Invest, Zinari Capital, among others),

- others targeting the Ghana market from outside the country (e.g. Aavishka Fund, Bamboo Finance, Leapfrog, and others ),

- other opportunities are coming from the banking sector (e.g. Fidelity Bank, Eco Bank, Sinapi Aba),

- and other through institutional investments from development partners such as EC, GIZ, IFAD, Mastercard Foundation, UNCDF, UNIDO, USAID, among others) or –

- for larger ticket sizes through institutional development investors (IIB, DEG, FMO, IFC, Proparco, SIFEM).

Impact Investing Ghana is the nodal agency in Ghana promoting the impact investing industry. It is very active in advancing the ecosystem development for impact investing in Ghana, and it has close cooperation with neighboring countries and the global impact investing industry (GSG) and networks. IIGh is also active in research, advocacy and policy advice. It is not a fund for companies to source investments; for this purpose IIGh works closely with DealSource, a platform for accessing impact investors. IIGh will also be a member of the investment committee under the proposed Risk Reduction and Social Innovation Fund (RRSIF)