What are IB and IGB business lines ?

Inclusive Businesses (IB) and Inclusive Green Businesses (IGB)

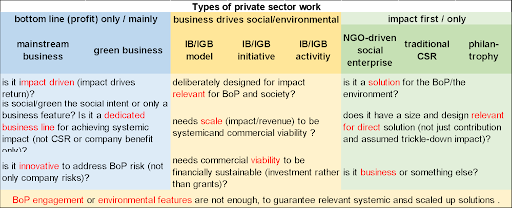

Inclusive Businesses (IB) and Inclusive Green Businesses (IGB) are commercially viable private sector business lines that create scaled-up, innovative and systemic solutions for the relevant income and living standard (IB) or environmental (IGB) problems of the poor and low-income people. (the BoP, i.e. the people at the base of the socio-economic pyramid, BoP, the bottom 40% income groups)

The business line is the determining factor to assess a company as IB/IGB. This is because companies sometimes have various business lines and not all may be relevant for IB. In many cases however, a company has only one business line. Investment incentives should only be given for the company’s achievements in the relevant IB/IGB business line.

IB/IGB business lines

IB/IGB business lines can be found in all sectors and are sponsored by companies of all (but micro) business sizes. Micro-enterprises normally do not have sufficient scale to be systemic. Start-ups often do not have sufficient proof in commercial viability, although some can be very systemic and hence included as IB-initiative. The table below indicates company sizes by revenue aligned with the Ghana industry standards.

Tresholds for small, medium and large impact and company sizes

| Company Size | Micro | Small | Medium | Large |

|---|---|---|---|---|

| Revenue in Million Cedis (GHS) | <0.5 | 0.5-7 | 7-30 | >30 |

| Revenue in Million USD | <0.05 | 0.05-0.5 | 0.5-20 | >3.0 |

| Profit Realization (gross profit, %, Sectors Specific) | <2% | 0-5% | 5-15% | >15% |

| social and environmental impact | For 1B/1GB the impact must be intended and direct | |||

| (sector and company size specific) | For MBIGBINGO-SEICSTR, the impact is often | |||

| [constructed through trickle-down assumptions. |

IB/IGB Business

Differ from mainstream business, green business, traditional CSR, and NGO-driven social enterprises in (a) their impact and business return orientation at the same time and (b) in their deliberate design for social or environmental change (no trickle-down assumption) directly benefitting the BoP.

IGB differ from green business (GB)

In their impact focus on the environment/climate footprint and poor and low-income people, and at the same time in their deliberate strategic design for systemic impact benefitting the country or the economy (not only the company).

Social enterprises

Can qualify as IB/IGB-initiatives, provided their business is commercially viable and for-profit and their impact is systemic and designed to scale and focused on the BoP.

Corporate social responsibility

Work of companies can also qualify as IB/IGB activity, provided it is for-profit and commercially oriented, and designed to pilot test a new core business line of the company.

Why should companies transform into IB/IGB?

IB/IGB have triple wins for people, planet and society/the economy. Companies engage into IB/IGB models because they

- (a) find new markets and distribution channels,

- (b) explore new sourcing mechanisms,

- (c) viability through using innovative businesses approaches,

- (d) save costs through innovation rather than people exploitation, and

- (e) feel recognized in the society and against their peers their for doing good while doing well, and

- (f) avoid impact washing and practice transparent and honest corporate governance. Furthermore,

- (g) often IB/IGB companies shave higher returns and profit margins than their mainstream business competitors.

Why other stakeholders are interested to build a better enabling environment for IB/IGB?

- Business associations like IB/IGB, because they bring social and environmental value to private sector development. They also prefer companies that do good (for society) while doing well (for the firm’s bottom line).

- Investors like IB/IGB, because of their innovative ways of addressing business and BoP risks, and their deliberate focus on generating business returns with social or environmental impact. IB/IGB investments can have higher financial returns than placing money in mainstream business, albeit the structuring of the IB/IGB investment often requires patient and innovative capital rather than purely profit maximizing objectives.

- Policy makers prefer IB/IGB because they (a) enhance inclusivity in a society by providing income or living standard solutions to BoP people, (b) reduce the budget allocations to care about the poor or provide essential goods and services to them, (c) help addressing environmental lor climate change problems and are at the same time beneficial for the BoP and the society, (d) promote economic transformation through innovative business models, (e) contribute to new economic growth potential in the country by expanding markets and by creating high business returns, and (f) fuel government budgets by creating taxable and growing revenue income.

- For development partners IB/IGB are the answers to generate value in private sector driven development results, and go beyond the objective of mere encouraging more private sector engagements in the economy or business growth.

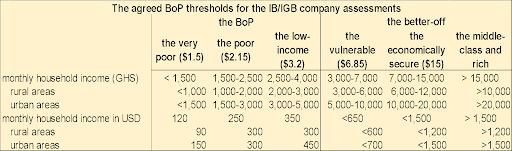

The BoP as main (but often not sole) beneficiary of IB/IGB firms are the people at the base of the social-economic pyramid, typically the poor and low-income people (i.e. the bottom 40% income groups). The BoP comprise the very poor, the poor and the low-income people. For Ghana we developed the following income thresholds to determine those IB/IGB target groups.

Women empowerment.

The IB/IGB concept emphasized benefits for people and particularly poor and low-income people. Part of this BoP group are women. However, the IB/IGB concept is not merely looking at women engagement, nor women ownership of companies, nor gender equality relations in a company. Rather it follows a women empowerment approach, meaning that women have to be socially and economically empowerment, and perhaps even more empowered than men, to escape their income or living standard or environmental poverty and exclusion. As part of the landscape study, some further research was done on how the IB/IGB companies and the stakeholders promoting them are seeing and implementing women empowerment. It was found that.

- (a) here is little understanding so far on true women empowerment,

- (b) companies in Ghana are not so innovative and effective with establishing women empowerment features, and

- (c) development support organizations – especially from government – do very little to empower women and rather focus on programs supporting women ownership of (mostly micro-sized or start-up) enterprises or find women engagement as such sufficient to achieve development results.

A relevant business solution differs from mere BoP engagement as laborers, consumers, suppliers, distributors or co-owners in its understanding of achieving a systemic change.

- For IB-income models (e.g. agrobusinesses), in addition of the number of BoP people engaged, the actual change in the income generated for the company’s suppliers, distributors or laborers (sometimes also shareholders as in the case of cooperatives) is the key criteria.

- For an IB-living standard model, criteria of affordability (not necessarily price of a product or service), accessibility and product relevance matter.

- For IGB the key criteria are addresses all necessary 6 environmental and 3 climate change categories, how

- (a) effective the company is addressing pollution,

- (b) it is enhancing natural resources management,

- (c) it is addressing the climate footprint of the company,

- (d) how systemic the company contributes to environmental sustainability for the given region, sector or country,

- (e) whether the environmental dimension is a business case, and (f) how the environmental feature directly benefits the BoP.