The Value Chain Approach and jobs

Value chain approach:

IB/IGB companies achieve most of the impact in their direct value chain that can be influenced by the company. Hence, counting jobs in factory only is not sufficient to capture IB/IGB relevance. Rather the impact in the supply, distribution, consumers and even ownership structure of the firm matters more than pure employment. For example, in an hospital case the impact is on the poor people treated and not the nurses and doctors employed. For an agrobusiness the impact is on the large number of suppliers or consumers (or both) of the product not only the few workers in the processing factory. For a finance company the number of clients matters to calculate impact and not the number of loan officers. Hence a small number of companies can have a large social reach, when the more relevant value chain approach is used. The company size is therefore also not measured by the number of employment but the revenue of the firm.

Innovation:

To work effectively in the markets of the poor and successfully address both business and BoP risks, IB/IGB companies need to be innovative. Business innovations are more relevant for such firms than mere technology innovations. IB/IGB companies are also often innovative in social and environmental areas. Innovative IB/IGB also use their CSR to pilot new business lines.

Transformation and triple wins:

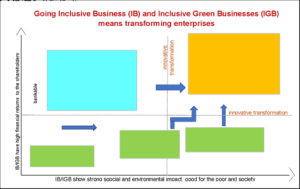

By achieving deliberate impact for the poor, the business’ bottom line, and the society, IB/IGB achieve triple-wins and are high relevant for the government. Being innovative and addressing solutions IB/IGB business are also transformative for the economy. They show examples of what the private sector can do to achieve change for the good by doing well. Helping more companies transitioning from a mainstream business (MB), a green business (GB), a grant and NGO based social enterprise (NGO-SE), or from doing traditional corporate social responsibility (CSR) work into an IB/IGB model, initiative or activity is the key purpose of a relevant IB/IGB support program. The chart below shows how IB/IGB companies are transformative in creating impact for more business return and economic growth on the one side, and more and better impact for the poor and the environment on the other and both at the same time. Hence the need for impact-drives-return business coaching and mentoring (IDR-BCM).

For more information on what is IB/IGB see this concept note.

The Value Chain approach and its implications for the job agenda

Jobs and income opportunities in the value chain:

The public discussion in Ghana has a strong emphasis on job creation. The underlying assumption is that jobs are generated in the formal economy, and these jobs pay well. However, 80% of the jobs in Ghana are in the informal sector, and most of these jobs do not pay well. Encouraging the informal sector to register as formal enterprises does not automatically increase the income opportunities of the people employed in such companies. Rather, employment income is a function of the productivity in a sector, among others, and in Ghana the productivity in industry – and particularly the formal sector, is low.

In emerging economies and developing countries most living standard and income related impact is created in the immediate value chain of a firm, which the company can directly influence. What matters for the IB/IGB discussion is social reach changes of the value chain emphasizing the BoP. For calculating social reach in the IB/IGB discussion only the direct social reach and the direct reach of BoP (not all people) is relevant. For example,

- an agribusiness A may have 60 people in its factory but actually sources all its inputs for that factory directly (contract farming relationships) from 10,000 farmers. Another agrobusiness B may source through 5-20 traders who work with 10,000 farmers. Yet another agrobusiness C is sourcing directly from 10,000 farmers and selling deliberately to 100,000 customers all being better off and agrobusiness D is also sourcing directly from 10,000 farmers and selling directly to 80,000 customers (the rest through traders). The social BoP reach of agrobusiness D is 38,448, that of company A 8.048, that of company B is 48, and that of company C is 6.448. Actually most agrobusinesses are the company B type. In such cases, the IDR-BCM (link to page 4.5). discussion would have a conversation on increasing the total social reach of company B by exploring whether they can engage in direct sourcing.

In another example, a hospital may have 100 employees under its payroll (doctors, nurses, personnel for kitchen, cleaning and administration. Hence the traditional labor market economist would count 100 jobs created as the benefit of the company. However, of these 100 jobs, only estimated 25 are from the BoP communities. And the value addition of a hospital is not the number of doctors and nurses it employs but the number of patients treated. Say the hospital treats 300,000 patients per year. Of these 300,000 people treated, in the case of hospital A only 10% are from BoP communities and in case of hospital B 40%. The total BoP impact (i.e. BoP jobs + BoP value chain beneficiaries) of hospital A would be 30.0125, while in the case of hospital B the number would be 120.025. It is clear that from a public goods perspective, hospital B should be prioritized. The IDR-BCM (link to page 4.5) discussion would emphasize how to increase reach in a hospital business. This is only possible if the services the hospital provides are

- (a) made more affordable (for example cheaper treatment costs and more installment payment or cooperation with health companies),

- (b) the hospital is better accessible for the BoP (for example through geographical location) and

- (c) if the services offered are more relevant for the BoP (for example by adding medicine to the hospital coverage treatment, or by focusing more on specific health needs of the BoP such as basic health services delivery like vaccinations, nutrition related problems etc.).