Commitment through the IB/IGB strategy and action plan

The IB/IGB initiative is a private sector-led, government-owned, and development partners supported program to create a better enabling environment for companies to transforming into IB/IGB firms that provide innovative, scaled up, systemic and relevant solutions for the poor and low-income people and the environment.

While discussing a possible support program for IB/IGB transformation going forward from 2025 onwards, the consultants found strong support so far for the proposed IB/IGB initiative and the strategic recommendations in the proposed program, including:

- Establishing a dedicated strategic commitment endorsed by government and private sector (not policy).

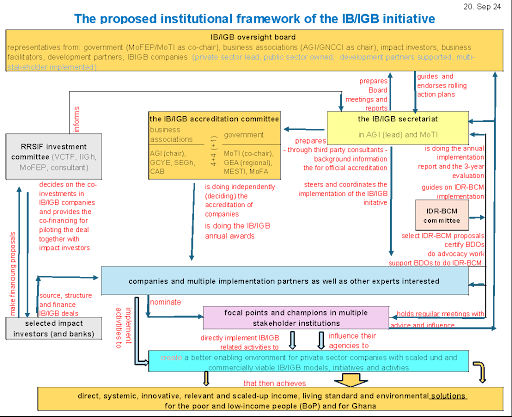

- The proposed multi-stakeholder institutional framework: with an oversight Board, an accreditation committee, a joint secretariat in a government agency and a business association, an IDR-BCM committee, and investment committee, focal points in various institutions, regular IB/IGB champions meetings).

- IB/IGB awareness raising work through business associations and other stakeholders (including workshops seminars and fora, knowledge papers, leaflets, radio features, video, IB/IGB website, newsletter, regular social media features, among others).

- IB/IGB accreditation jointly done by government and business associations. This is based on a composite rating tool with transparent criteria and benchmarks, and documentation of companies (maybe 20-30 per year) done through third party interviews.

- Business coaching under an impact-drives-return focus (IDR-BCM) and certification and follow up training of experts doing this.

- Targeting IB/IGB in SME promotion programs (link to page 4.6) with concrete commitments from multiple stakeholders.

- Establishing smart and budget neutral incentives (still in discussion) or including IB as dedicated features in existing tax, procurement, trade and other investment incentives.

- Creating a regional risk reduction fund for impact investors (RRSIF) , eventually championed by VCTF and under West Africa regional perspective.

- Facilitating impact monitoring and reporting at company, thematic and cross-sectoral, as well as program levels. And

- Institutionalizing an annual Africa-wide regional exchange on IB/IGB and its promotion, also through linkages top major business and impact investors summits (such as the Africa CEO summit, Africa Sankalp events, and Impact Investing meetings).

Endorsement: The 10 strategic recommendations will be further detailed. The 10 strategic recommendations will be principally endorsed through a letter by the three parties representing the private sector led, government owned and development partners supported initiative, i.e. AGI ((link to page 5.4) (as representative of the private sector), MoTI ((link https://moti-gh.com/), (as suggested focal point on the government side, and GIZ (link to page 5.5) (as focal point for involvement of development partners).

The initially estimated costs for implementing over 5 years is USD 6 million in technical assistance and USD 25 million for the investment fund. Implementation could start in 2025.

The IB/IGB initiative will be implemented by multiple stakeholders (link to page 5.6). An implementation action plan developed by January 2025 will solicit possible contributions from those actors by integrating IB/IGB features in their existing programs, and extra contributions from private and public funders, development partners (public and private) including GIZ.

Institutionalizing IB/IGB support

A dedicated institutional structure will be set up to promote the implementation of the IB/IGB strategic program. This will include

- A mulct-stakeholder oversight board to guide the strategic directions and its implementation. The Board will be composed of 2-3 representatives from each of the 6 stakeholder groups (i.e. government, business association, .private sector IB/IGB company, impact investor, business facilitator, and development partner. Selected Board members can rotate on a yearly or bi-annual basis.

- A secretariat, chaired by AGI (link to page 5.4) and co-chaired by MoTI ((link https://moti-gh.com/), to coordinate the implementation of the program and stimulate partnerships.

- An accreditation committee to decide on which companies will qualify as IB/IGB. The committee is composed of 4 members each from the private (AGI, CAG, GCYE, SEGh) sector and the government (MoTI, GEA, MESTI, MoFA).

- An IDR-BCM committee deciding on support to companies and business facilitators under the IDR-BCM scheme, doing certification of dedicated IDR business coaches, and advising the Secretariat and the Board on further technical assistance needs. This committee will be represented by the Ghana Impact Hubs (Network GHN) (link to (https://ghanahubsnetwork.com) , the Enterprise Support Organization (ESO) (link to https://esoghana.org/) collaborative, the Ghana Climate Innovation Center (GCIC) (link to ), and the Ghana Enterprises Agency (GEA) (link to ).

- An investment committee for endorsing the financial proposals for the risk reduction and social innovation fund (link to page 4.8). The committee is proposed to be composed of a representative each of Impact Investing Ghana (IIGh) (link to https://impactinvestinggh.org/) the Venture Capital Trust Fund (VCTF) (link to https://vctf.com.gh/), and Ministry of Finance and Economic Planning (MoFEP) (link to https://mofep.gov.gh/), as well as a consultant doing background due diligence work on the proposed deals and their social/environmental impact.

- Dedicated focal points (and their alternates) in government and other agencies to promote IB/IGB. And

- IB/IGB champions in multiple stakeholder agencies and companies coming together regularly (maybe 2 times a year) and in selected working groups to exchange on IB/IGB promotion.

The role and functions of the various institutional bodies is summarized in the chart aside.

Awareness raising for widening ownership and knowledge

Business associations and other organizations will do awareness raising seminars on IB/IGB. In 2024 the following awareness raising work was done in Ghana:

- Seminars and institutional briefings

- IB/IGB seminar for social enterprises (March 2024)

- IB/IGB briefing for social enterprises as part of the GIZ-agribiz and SEGh event (17 Sept 2024)

- IB/IGB briefing for AGI members (January 2025)

- Technical briefings

- For CAG on how to do accreditation and the benefits of IDR-BCM (1 Oct 2024)

- For the accreditation committee members (15 October 2024)

- For selected business facilitators on impact drives return type of business coaching and mentoring (14 and 21 November 2024)

- IB/IGB stakeholder seminars

- for business facilitators and business associations (4 July 2024)

- IB/IGB stakeholder seminar for stakeholders in the northern regions of Ghana (9 July 2024)

- IB/IGB stakeholder seminar for impact investors (11 July 2024)

- IB/IGB stakeholder seminar for development partners (12 July 2024)

- IB/IGB stakeholder seminar for government agencies (16 July 20924, postponed to January 2025)

- Business coaching

- As part of the company interviews (March-October 2024)

- For impact hubs on impact drives return type of business coaching and mentoring (21 October 2024)

- IB/IGB Forum

- First Ghana IB/IGB Forum (22 October 2024)

- One-on-one business coaching for companies with IB/IGB business lines (23 October 2024=)

- 2st IB/IGB award, organized by AGI (09 November 2024)

Further awareness raising work will follow.

Accreditation for targeting the right firms

The purpose of IB/IGB-accreditation is to establish ownership for a transparent identification of companies with IB/IGB business lines, so that the companies get branding and recognition, and incentives can be targeted to the right firms.

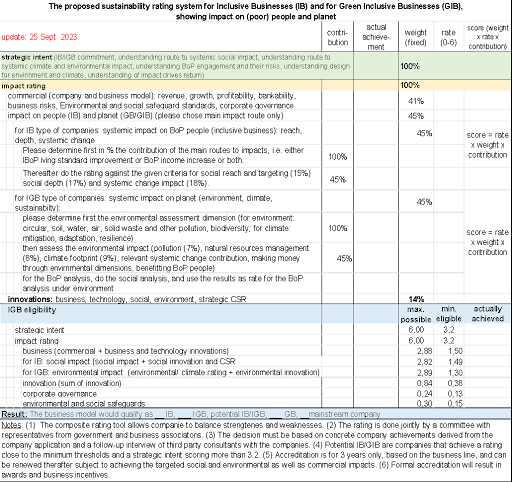

An accreditation system was developed for Ghana and similar approaches are already implemented in other countries in Africa and Asia. IB/IGB accreditation is tool to identify such firms, rate them against 48 criteria and 184 benchmarks, and thus transparently qualify which business line is IB/IGB and which not. The accreditation tool is simple to implement and can be used across sectors and across company sizes. It basically determines the company’s attribution to social or environmental change in a society. The accreditation will be given on the respective IB and IGB business line and need to be renewed all 3 years. It will be done annually and on a consensus decision.

4 levels of criteria are used to accredit an IB or IGB firms. These comprise:

- The strategic intent of the company (betterment for BoP people or for the environment/climate footprint). The strategic intent rating is a separate analysis.

- The commercial viability of the company (with criteria on revenue, growth, profitability, bankability, addressing business risks, social and environmental safeguard adherence and corporate governance quality). The commercial viability comprises 41% of the total scoring.

- (c) for IB the social impact (in terms of reach, targeting, women empowerment, social depth, systemic social change contribution), and for IGB the environmental impact (in terms of addressing pollution and circular economy issues, addressing natural resources management addressing the climate footprint, the sustainability of the environmental intervention, how the company makes money with the environmental features, and what the impact of the environmental features is on the BoP) The social or environmental impact rating comprises 45% of the total scoring.

- The innovations the company introduced to achieve those results (in terms of business innovations, technology innovations, social innovations, environmental innovations , gender equality, and strategic CSR use). The innovation impact rating comprises 14% of the total scoring.

The analysis is done through a composite rating tool, quantifying the company’s impact against weighted criteria (48) and their benchmarks (186) for small-medium-high impact (in numeric terms 0-6. In 0.5 counting steps). The composite rating is done under a team and consensus approach. Companies with a scoring above certain eligibility thresholds would qualify as IB/IGB, those just below as potential IB/IGB and those far below as mainstream or green business. To allow more GB to qualify as IGB, the environmental impact eligibility thresholds are slightly lower than the social impact ratios for IB. A summary of the proposed IB/IGB rating tool is in the chart below

The official IB/IGB accreditation is done by a committee comprised of 4 representatives each from government (MoTI, GEA, MESTI, MoFA) and business associations (AGI, GCYE, CAG, SEGh). The consensus decision of the committee is binding. Official accreditation should be done 1-2 times a year and estimated 20-30 companies will be accredited in every exercise.

Impact assessment and awarding would cost about USD 50,000-USD 70,000 per year. This is mainly for analytical background work, company interviews , and initial ratings done through consultants. For more information on the accreditation system please see this paper (link to paper number 3)

Eligible for investment incentives: Accredited company will be awarded by the business associations. Accreditation will not only give branding and recognition to the companies, it will also trigger business coaching ((link to page 4.5), investment (link to page 4.6) and financial incentives (link to page 4.) under the IB/IGB support program.

The first accreditation round (for 2024) proposed 15 companies as IB/IGB (link to page 3.1). They had in 2023 a consolidated revenue of GhC 988 million and a consolidated reach of 1.9 million poor and low-income people. The 15 companies have a strong growth projection for both revenue and reach through 2030. Imagine, if only 15 companies can achieve so much, how transformative the IB/IGB initiative can be for social inclusion and the economy in Ghana when it is upscaled

Projecting achievements through 2030 in an up-scaling scenario: It is assumed that 20-30 firms being confirmed by the IB/IGB accreditation committee in each round, resulting in up to 300 firms by 2030 that would perhaps qualify as IB/IGB in the coming 5-7 years. These assumed 300 firms (by 2030) may then have by 2030 a total social reach of minimum 3.8 million BoP people (11.3% of total Ghanaian population and 24 % of total BoP) and a revenue of GHS 7.5 billion GHS (0.6 billion USD). Note that different to a typical development project, revenue and reach of a private sector implemented change repeats every year and does not achieve only once in the lifetime

Business coaching and mentoring under an impact drives return approach

Mainstream business development services:

To promote enterprise development, many institutions from government, business associations, development partners and business facilitators finance programs for business development. Most of these programs are training courses for start-up firms, emphasizing basic business knowledge around the business establishment and value chain analysis frameworks or through people-centered business approaches (among many others). There are many training courses for micro and small enterprises, implemented by NGOs or start-up support consulting firms. In addition, medium and larger companies pay for specialized one-on-one business coaching to enhance their commercial viability or to explore new markets, get advice on internal restructuring, merger and acquisition, or recommendations for cost saving mechanisms.

Business advisory tools on how to make IB/IGB are missing:

The traditional business advisory tools do not specifically focus on the social impact of firms, nor on how more social or environmental impact can dynamize also more business returns The IB/IGB literature is mainly descriptive in showing good examples, although some studies (esp. from IFC) and a few consulting firms (Hystra, ENDEVA, BoP Inc) synergize learnings.

While there are tools to measure impact, these are typically used at portfolio level and are not necessarily designed as a dynamic instrument to inform the company enhancing its business performance through achieving more social impact. For companies in the growth phase that wish to combine social impact and commercial viability, specific business coaching tools on designing for where impact that thrives commercial return and vice versa are missing.

Business schools increasingly offer courses on environmental sustainability and adherence to social safeguards, but not (yet) on developing IB/IGB business models. Such tools would need to explain how a company can transform its current business model into an IB, how an NGO-driven social enterprise can transform into an IB initiative, how a corporate social responsibility can be made an IB activity.

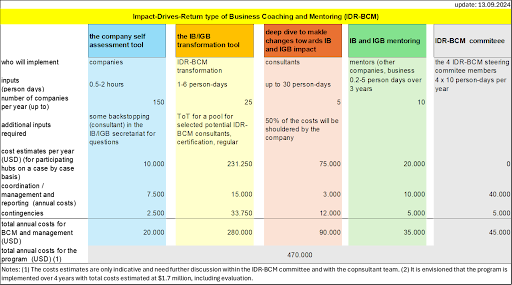

The IB-BCM tool has 4 components:

- The IB/IGB readiness assessment tool is a succinct help for self-assessing a company whether its business would perhaps qualify as IB/IGB and which specific areas of the business needs improvement to become a real IB/IGB. The tool can also be used by government, business associations and development partners implementing portfolios for micro and SME support, value chain development to focus their programs better on achieving systemic and deliberate (not trickle-down) results for poverty reduction and social inclusion, while at the same time enhancing commercial viability and business growth. Such tool would require per company perhaps 30 minutes assessment through a flow. The subtool 1 is further described

2. The second component is the IB/IGB transformation tool. This tool implemented by business facilitators (consultants) to help interested companies with IB/IGB potential making the transition from

- From a mainstream business to an IB/IGB-model, or

- From a corporate social responsibility (CSR) work stream to a core-business commercial IB activity with much larger and more sustainable impact, or

- From a NGO driven social enterprise (with small social reach and low commercial viability if at all) to a scaling IB initiative, or

- From an IB/IGB model to a much better IB/IGB model with higher and deeper and more transformative impact and better commercial viability and returns.

- The tool would be used by specifically trained IB/IGB business advisory service consultants; it can also be used by mainstream business consultants who have undergone additional training and would use the tool as part of their ordinary business services. Typically, IB/IGB transformation ends with an advisory note giving clear directions for IB/IGB transformation as agreed with the firm. Two to six person-days of dedicated discussions with the company would be required in an intensive and focused one-on-one discussion with the firm. The subtool 2 is further described

3. The third tool is for IB/IGB deep dive. This tool will help consultants orienting their specific advisory support to create more social or environmental impact. It is a financing facility for preparing – for example: (a) a revised business plan, or (b) a market assessment, or (c) a re-orientation of the input sourcing, or (d) a social or environmental impact assessment coming up with clear recommendation to implement changes in the business line for achieving impact for the BoP and the environment/climate, or (e) recommendations for company internal institutional reforms on the way to become IB/IGB, or (f) for institutionalizing impact monitoring and reporting, Such deep dive support would be typically 15-40 person-days of expert inputs. It would be given only to companies with business lines already accredited as IB/IGB.

4. The fourth tool is for IB/IGB mentoring. It is developed particularly for business associations with mentorship programs, and would help those associations and their consultants adding IB/IGB advise to their mentorship programs and thus achieving more social impact and higher business returns at the same time. Specific advisory suggestions will be developed for different stages of IB/IGB mentorship over a 2-3 year program per company. The tool 4 is closely linked to the structure and content of tool 2; however it would have more business case examples for the mentor to draw on. The IB/IGB mentorship program would have a back-up expert, to whom the mentors under the business associations can seek advice on IB/IGB related questions emerging in the discussions with the mentored companies.

The chart gives an overview of the 4 tools, the implementation structure, number of firms benefitting and costs per year. In addition to the outputs and costs indicated therein, i.e. costs which are proposed to be provided through the IB/IGB support program, addition inputs will come from the multiple stakeholders.

Investment incentives for IB/IGB companies

Accredited IB/IGB companies will be eligible to existing government incentives with regards to tax, procurement, marketing and trade, financing, technical assistance and other support. To this end IB/IGB will be referred to as a specific business line under the various government programs.

Of particular interest is targeting IB/IGB in smart tax incentives that do not jeopardize the government’s revenue basis but actually increase taxes.

Similarly, innovative procurement incentives for IB/IGB firms delivering better results and actually cheaper than government services van be a very powerful instrument for creating more social and environmental results through contracting the more suitable private sector interventions. For example, government bodies could commit purchasing X% of their school feeding or learning equipment programs, Y% of their health subsidies, Z% of the environmental services (e.g. waste recycling or for biodiversity), V% of their water and sanitation or U% of their decentralized rural electrification infrastructure programs through accredited IB/IGB firms.

The further identification of investment incentives for accredited IB/IGB companies will be done starting January 2025 (after the new government is in place). Of particular importance is to set the right criteria for targeting IB/IGB in such incentives (beyond being accredited) and to influence decision makers at the operational level to actually to what implementation rules are guiding.

Championing change: The development of incentives will be done in close cooperation with AGI and other business associations as well as government agencies esp. under the Ministry of Finance and Economic Planning.

Targeting IB/IGB support in development programs

Various development partners, government agencies, business associations, impact investing firms, and business facilitators run programs for small and medium enterprises development. IB/IGB targets can be included in those programs. Many organizations have already confirmed their interest in including IB/IGB in their existing programs and few have given concrete targets so far. For example:

- For business coaching under an impact drives return approach, organizations like, Ghana Climate Innovation Center, Ghana Hubs Network, Ghana Chamber of Young Entrepreneurs, GIZ-Agribiz, ILO, IFAD, Innohub, Mastercard Foundation, PWC SNV, agrobusiness program showed interest.

- In the field of impact investing, finance related organizations like IIGh, CiGaba, Eco Bank, Fidelity Bank, Sinapi Aba, Wangara Capital, Zinari Capital, among others, were interested

- In the field of advocacy, business associations like AGI, GCYE, GNCCI, Social Enterprises Ghana, but also organizations like ESO collaborative, Ghana Hubs Network, Social Enterprises Ghana – among others – are interested in promoting the IB/IGB agenda.

- Government programs particularly under the Ghana Enterprises Agency (GEA) and the Ministry of Food and Agriculture (MoFA) and partly also Ministry of Environment, Science Technology and Innovation (MESTI) are also interested in emphasizing more IB/IGB support.

- Development partners and foundations interested in the IB/IGB agenda are – among others: AfD and Expertise France, AfDB, EC, FCDO, GIZ, IFAD, ILO, Mastercard Foundation, the Netherland’s technical assistance organization RVO, UNCDF, UNIDO, USAID, World Bank, among others

The IB/IGB initiative will prepare by January 2025 an action plan summarizing the commitments from various partners as contributions to the IB/IGB initiative under existing and new programs.

Financing risk reduction and social innovation

Rationale for a fund that reduces the investment risks of IB/IGB investors:

When discussing with impact investors and IB businesses, it is always argued that sufficient funding is available in the market, but investors are reluctant or need lots of time to structure the respective deals. This is mainly because of two reasons:

- (a) the proposed project is not investment ready or does not have sufficient social impact, and

- (b) investors perceive risks – real or assumed – and prefer to wait and see the company’s further performance potential, before actually investing in a new business model.

Unleasing impact investing funding:

While business readiness will be addressed through business coaching services, investors’ readiness can be encouraged by establishing a risk reduction financing facility. Often, impact investors are close to making a deal, but there are a few perceived or real risks which hinders them to a final agreement with the company. In such case, a modality that helps reducing the risk for the investor would come in handy. Such risk reduction facility or fund (RRF) would thus unleash investments that are nearly investment ready but do not materialize due to various reasons.

Unleashing additional funding as investment strategy:

One of the 10 emerging recommendations for a strategy in support of IB/IGB is to establish a Risk Reduction and Social Innovation Fund (RRSIF). The fund would help reducing investment risks of impact investors and enhance innovations for deepening social inclusion.

Co-investment:

IB-RRSIF is structured as a public sector fund which would co-invest with impact investors in IB-deals (maybe 10-20%) proposed by impact investors, thereby reducing the investment risks and enhancing social (and environmental) impact.

Structuring the risk reduction component:

The $25 million fund would have two components:

- The risk reduction component where the government investment part could transfer into a grant, when the investment emerges as being substantially less commercially viable as initially plant due to unforeseen reasons, but still achieves its social impact. The risk reduction is similar to a guarantee, but it is more an upfront outcome-based risk reduction financing. In addition

- The RRSIF would have a small social innovation grant ($0.1-$0.3 million per deal) for piloting last-mile expansion to the poor.

The RRSIF vehicle would be run by an investment committee chaired by Ministry of Finance and managed by the Venture Capital Trust Fund (VCTF). No fund managing firm would need to be involved. It is structured as a public sector loan for private sector support, not as a partial credit guarantee given directly to private sector

Expected results in Ghana:

It is expected that the $25 million RRSIF will make investments in 50-60 small, medium and larger IB/IGB deals and thus unleashes a total financing of $118 million in 5 years. The returns from the fund would be re-invested in new IB/IGB deals (revolving fund).

The Africa regional dimension:

The RRSIF will be designed as a regional fund to hedge investment risks in Africa. Total fund costs would be about $50 million or more, of which perhaps 40% would be for Ghana.

Impact monitoring and reporting

Impact monitoring is an important tool to inform the management of a firm on strategic ways to enhance social/environment as well as commercial results of the business. Impact o offers opportunity to change the business to become more impactful. It also helps in reporting to investors and the public on the actual achievement of the company.

For companies impact monitoring to be effective needs to become an intrinsic component of their business and therefore be institutionalized in the business feedback. Hence it has to be designed as a simple, affordable and relevant informative tool so that impact assessment can be repeated annually and result in effective reporting. The standards for impact measurement need to align with the accreditation criteria and benchmarks.

At sector, thematic and program levels, impact monitoring and reporting helps development partners, governments and support organizations to adjust their program for supporting more results on the ground.

The IB/IGB initiative intends to provide technical assistance funding for impact assessment and reporting at those 4 levels, namely facilitating impact monitoring

- For companies to design appropriate impact monitoring tools (the actual reporting on an annual or bi-annual basis needs to be financed by the company to be sustainable.

- For sector studies commissioned by the IB/IGB secretariat to accumulate learnings of IB/IGB approaches and help business mentors advocating that learning.

- For thematic studies commissioned by the IB/IGB secretariat to develop new knowledge on cross-cutting subjects such as for example on (a) how to do women empowerment, (b) how to encourage social enterprises to transform to IB/IG, (c) how to make incentives more effective, (d) how to encourage more green business to transform m into IGB, (e) etc.

- At program level a consolidated impact assessment should be done all 2-3 years reporting on the progress of the IB/IGB initiative and more importantly making suggestions for changes in the program to become more effective.

Regional exchange

IB/IGB companies, investments and policy support programs are emerging in various African countries. However neither the companies nor the policy makers are aware of innovations happening outside in Africa and particularly in Asia. In result there is little if any exchange on knowledge nor learning from practices.

The IB/IGB initiative wishes to change this by establishing a regional forum to exchange on IB/IGB in Africa. To this end it is envisioned to

- jointly populate the existing AfricaIB website and Africa IB-newsletter through contributions from multiple African countries , companies and experts. The Africa IB website and newsletter was established by Nextier (a Nigeria based consulting firm) but needs sustainable funding to scale it up and institutionalize contributions from multiple African sources.

- In addition, it is planned t create an annual regional exchange through an Africa IB-Forum, perhaps back-to-back to the regular Africa business summits. Regional development institutions.

- The regional exchange could also include funding to co-finance regional knowledge sharing events promoting IB/IGB in Africa.

In Asia , the Association of Southeast Asia Economies (ASEAN) is promoting regional IB Forum and further joint IB work since 2016. IB promotion is part of the AASEAN small and medium enterprise working group under the economic ministers. An ASEAN-wide regional IB strategy was approved by all 10 heads of ASEAN states in 2020 and an action plan endorsed in 2023. The ASEAN Forum is also doing regular exchange with African countries.

Institutionalizing regional knowledge exchange: Discussions are ongoing with development institutions with a regional focus like the African Development Bank, the European Commission, the World Bank, and private sector foundation like MasterCard Foundation or Gates Foundation may be interested to engage in promoting regional exchange ion IB/IGB promotion. The costs for promoting a regional exchange package can be modest, but impact is rather large.